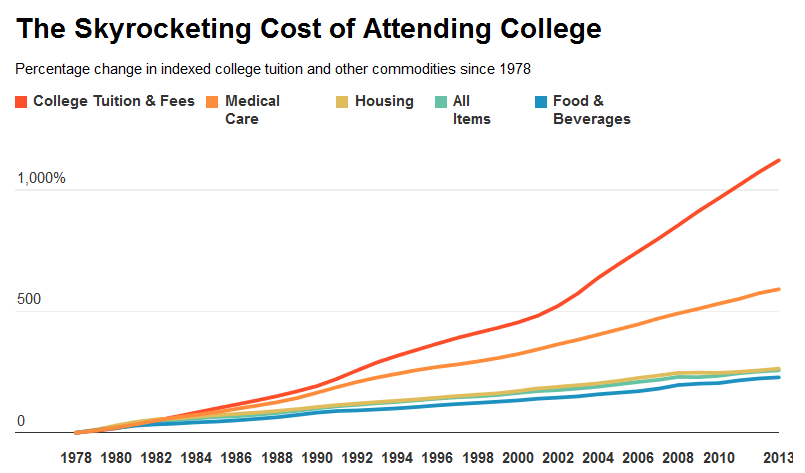

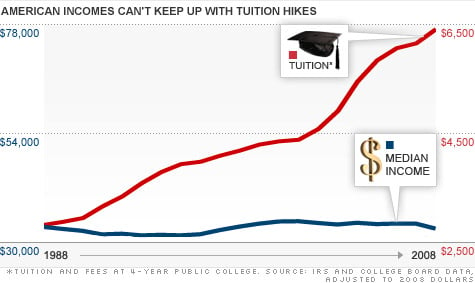

Considering the tuition of colleges from the late 1980s to the 2018 school year, it is clear to see that the cost of a typical undergraduate degree increased by a whopping 213% at public schools and by 129% at private schools. This figure was reached even after it was adjusted for inflation. As 45 million Americans are currently drowning in student loan debt of over $1.5 trillion and less than 55% of students graduate in 6 years, it raises the question: why is College tuition is the highest it has ever been?

Reasons for growing college costs:

1. The number of College applicants is growing

According to the United States Department of Education Department, colleges in the country experienced a total of 20.4 million students in 2017, over a 5 million increase from the year 2000, indicating a simple cause of Supply & Demand. According to Richard Vedder, an author and distinguished professor of economics emeritus at Ohio University, this is because the rewards offered by obtaining a college degree have expanded and grown over the years. When demand goes up, and supply does not match it, it is sure to raise prices.

Others impacted by the high cost of tuition believe it not to be the rewards of earning a college degree, but rather the fact the many entry-level positions require a degree of higher education for mere consideration. The cost of these high prices is felt solely by the students and their family. In a bid to circumvent this, most people have no choice but to borrow money.

According to a report made by the American Academy of Arts & Sciences, between 2000 and 2012, the percentage of students who took out loans increased by 10%. In addition, according to MakeLemonade.com, a personal finance website, the average student in the Class of 2016 had over $37,000 in student loan debt.

2. More Financial Aid = Higher Cost

According to Vedder, student borrowers could also be the reason why government financial-aid programs have increased and why tuition is on the rise. “In 1970, financial-aid programs were almost nonexistent. Generally, middle-income people didn’t get money from the federal government; the large majority of students did not.”

However, in 1978, Congress passed a bill known as the Middle-Income Student Assistance Act. This made all undergraduates, regardless of income class, eligible for subsidized loans and middle-income students eligible for Pell Grants, according to NASPA, Student Affairs Administrators in Higher Education. “More and more students started applying for financial aid, knowing that students will get this financial-aid money, the university raises fees and takes advantage to capture that themselves,” Vedder said.

3. High Salary for Professors, Lecturers & Instructors

According to a professor who spoke with Business Insider, “The primary mechanism for delivering higher education at most institutions are highly educated people. Acquiring and recruiting highly educated faculty and staff costs money, especially in jobs with significant demand outside academia.” Full professors at public doctoral institutions made $126,981 in salary in the 2013-2014 academic year, and instructors at those schools made $50,032. Presidents of public doctoral institutions, meanwhile, saw their salaries rise 11.3 percent on average over the past seven years, according to an article by The Washington Post.

4. Like other things in the economy, student services are getting expensive

Let’s face it; the growing high prices does not stop at education. Today, everything costs more than it was a few years ago and colleges are not immune to this. When students were told to rank in ascending order what causes the most pain as regards to college, tuition came in first followed by paying for textbooks. Most students —85% — said paying for books was more stressful than paying for food, health care or rent and some students said they deliberately reduced the number of classes they had to take as to reduce the cost of books.

Regrets over a degree

For more American graduates who took out a loan to pay for the rising cost of books and tuition to get that degree, it was not worth it to many students who face high-interest rates and high monthly payments, especially for those who cannot get a high-paying job out of school in their field.

This was according to a study done by Varo Money which found out that over a third of recent college graduates said that the degree they received was not worth the sum of which they were now indebted. The survey also discovered that those still in college showed more optimism about the value of their degree as opposed to their graduate colleges suggesting that the disillusionment may have set in after graduation.

Finally, as the cost of college continues to rise and the value of degrees decline in today’s world, is it a matter of time before the majority of students choose to completely circumvent the system completely? When determining whether to go to college or not, it’s important to educate yourself as to whether or not the cost of college is worth it. If you are confident that your education will pay off, then going to school may be worthwhile.

To help you stay motivated on your education journey, or if you are one of the 45% who couldn’t afford to graduate or receive your transcripts, consider a Realistic looking degree from the school of your choice from RealisticDiplomas.com where you can have an undergraduate or Graduate degree shipped to you in a matter of days!